In one of our recent insights pieces, we explored Why The South East Property Market is Booming, and we identified that Kent, in particular, was a real hotspot. We found that it’s experiencing the highest percentage of new build homes within the entire South East, especially for family homes. We also saw that Canterbury was experiencing both the highest demand and showing strong price performance.

But why?

What makes Kent special, while neighbouring East Sussex is one of the worst-performing counties in the South East? Well, this article explores why property development in Kent is doing so well.

Why is Kent So Desirable to Live In?

Famously known as The Garden of England, Kent is a very desirable place to call home. With some of the warmest average temperatures in the UK, plenty of sunshine, beautiful rolling countryside and glorious coastlines.

Importantly, it also offers fantastic transport links to London, the rest of the UK via the M25, and mainland Europe via the Channel Tunnel and Dover-Calais ferry crossings. Lastly, there are plenty of urban, suburban and rural areas to suit different buyer requirements.

Major population centres include Maidstone, Medway, Ashford, Margate, Tunbridge Wells, Canterbury and Gravesend, as well as countless smaller towns and villages. It’s particularly popular with families and professionals who want to make their money go further than in the capital, or want to raise a family in quieter, calmer surroundings.

Across the county, you’ll also find plenty of good schools and hospitals, a wide variety of employment opportunities, ever-increasing numbers of cultural things to do, and tons of outdoor pursuits.

The Figures Behind The Facts

Affordable Kent

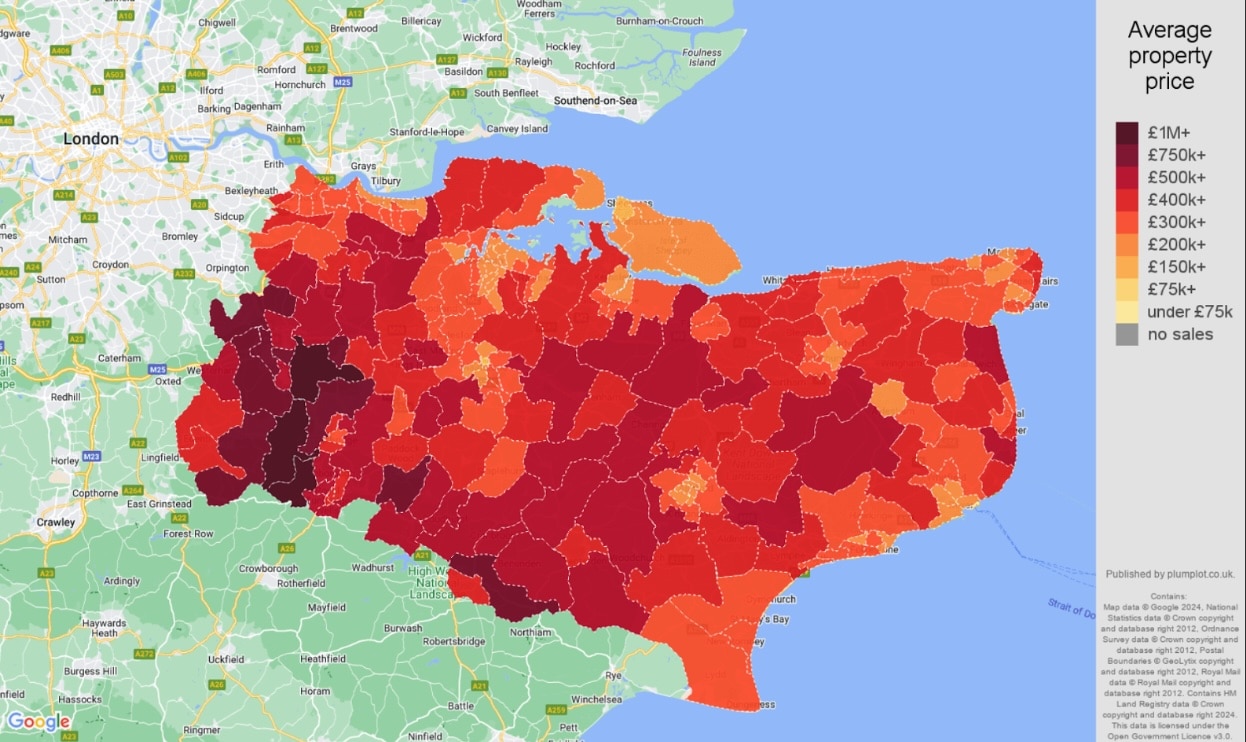

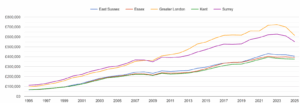

While the South East as a whole has some of the highest house prices in the UK, Kent is one of the more affordable areas. Sitting at 13th overall (out of 55) in the UK, with an average house price of £383,686, Kent is more affordable than London, Surrey, Berkshire, Buckinghamshire, Oxfordshire, West and East Sussex, while still offering many of the benefits of those counties.

Similarly, although average house prices have stagnated somewhat since 2022, they haven’t experienced the noticeable drops in prices seen in London or Surrey:

Kent’s Property Price Hotspots

Kent shows considerable range when it comes to average house prices by postcode. At the low end, the CT20 postcode in Folkestone and Sandgate has an average of £207,000, whereas the TN15 postcode in Sevenoaks boasts a £1m average.

Broken down by region, we can see that the west of the county, around Tunbridge Wells, Sevenoaks and Tonbridge commands the highest prices. On the other hand, the southern coast and Medway region are among the lowest.

However, given the latter’s excellent rail links into central London, it could represent a fantastic opportunity for ambitious developers to build or renovate properties targeted at families leaving the capital and to maximise their budgets.

New Builds Still Rule The Pricing Roost

Like the rest of the South East, new build homes in Kent still command higher average prices than existing homes – £414,000 vs £382,000, respectively. However, new builds make up just 4.1% of the total number of sales between July 2024 and June 2025, a drop from around 12% in 2023:

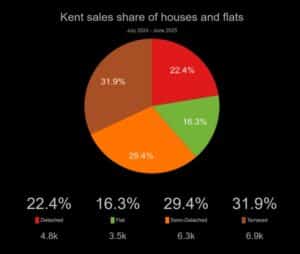

Much like the South East as a whole, typical family homes make up the bulk of sales in Kent.

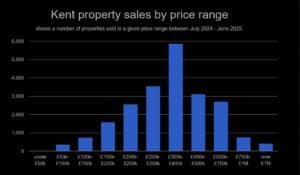

For developers looking to build or renovate, they’ll likely give themselves the best chance of decent returns on a detached or semi-detached property, especially if it falls within the £250,000 to £400,000 price range.

- £50k-£100k (1.6% of sales, 352 transactions)

- £100k-£150k (3.4%, 740)

- £150k-£200k (7.3%, 1.6k)

- £200k-£250k (11.8%, 2.6k)

- £250k-£300k (16.4%, 3.5k)

- £300k-£400k (27.2%, 5.9k)

- £400k-£500k (14.4%, 3.1k)

- £500k-£750k (12.5%, 2.7k)

- £750k-£1M (3.5%, 752)

- over £1M (1.9%, 418)

Property Development in Kent

Clearly, Kent could be a great area for property developers to make healthy returns. With more and more people moving away from London, Kent offering a desirable place to live, and a growing desire among local authorities to prioritise housing development (especially in the Medway area), it may be the time to bring those development plans to reality.

In areas with good schools, plenty of employment opportunities and good links to London, we may see demand increase over the coming months and years.

If you need finance to bring your next project to life, we’ve got years of experience in funding successful projects across the South East. We have a range of property development finance options to suit your needs, and we can typically offer an agreement in principle within a week. To find out more, contact us today!