Despite a volatile few years in the UK economy and housing market, the property development market is still going strong and developers are still seeing good returns on their investments. In this blog we will explore the different types of property development and which type of property is worth building right now.

Sustainable and Eco-Friendly Homes

There is a growing emphasis on sustainability and energy efficiency, with more new-build homes incorporating eco-friendly features such as solar panels, efficient insulation, and rainwater harvesting systems.

We are seeing an increasing number of properties being built with ICF blocks. ICF (Insulating Concrete Forms) blocks are building blocks made of polystyrene that create an insulating material which is very quick and flexible to build with.

With the cost of living and energy crisis still at large, consumers are increasingly looking for energy-efficient homes. Building with efficient materials can be a real selling point for new builds and redevelopments as consumers increasingly look for ways to reduce their monthly outgoings.

Flats and apartments

In urban areas and city centres, apartment buildings are popular due to their space-efficient design and proximity to offices, amenities and transportation. Where space is limited, it makes sense to build upwards.

Whilst the 2020 pandemic initially saw a trend of people moving away from city-centre flats, the demand has been on the rise since normal life resumed. In fact, data from Rightmove shows that searches for flats overtook terraced properties at the start of 2022.

With ground space so limited, apartment builds are usually redevelopment projects, converting an older building into multiple flats which can offer a much greater return on investment.

Terraced Houses and Town homes

In both urban and suburban settings, terraced houses and townhomes are common, offering a balance between detached homes and apartments in terms of size and price.

New-build homes with private gardens or access to communal outdoor areas are particularly appealing to many buyers, especially those looking for a balance between urban living and green spaces. Many people were left stuck indoors during the pandemic lockdowns which drove a huge increase in demand for properties with gardens or outdoor areas, a trend that continues.

First-Time Buyer Properties

There has been a focus on building homes catering to first-time buyers, often in the form of smaller properties or apartments with more affordable price points. With the end of the help-to-buy scheme, the number of first-time buyers has reduced by nearly 50%.

Affordable new-builds which can offer sales incentives such as stamp duty relief or mortgage payments will continue to be strong for first-time buyers, who may be looking to save the pennies wherever they can.

Smart Homes

With the rise of smart home technology, many new-build properties are incorporating features like integrated home automation systems and energy management tools.

Not only does this provide the home owner with total control over their energy and power use, it offers enhanced security and a whole host of home comforts at the tips of their fingertips. The recent soaring of energy costs has left consumers looking to make energy savings in any way possible, making smart homes a more appealing concept for the future.

Smart home technology can offer a real boost to the appeal of a property and so many developers are incorporating it into their redevelopment projects.

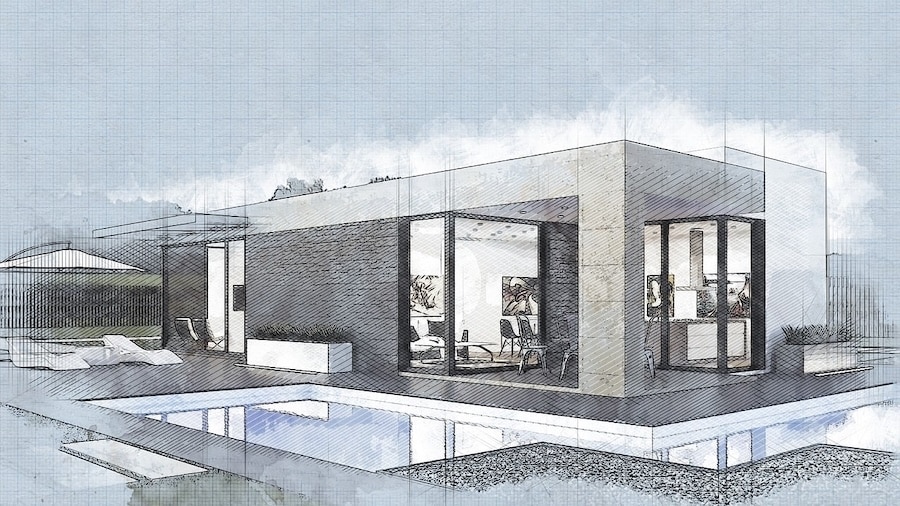

New Build

The demand for new build properties continues to increase as many people opt for a new build development over older, period properties which can be costly to maintain.

New-build apartment registrations increased 45% in London in 2022 compared to the year before, while registrations across all new-build property types continues to increase.

As people continue to look to reduce their monthly outgoings, newer build properties begin to look more favourable thanks to reduced property maintenance and more energy-efficient materials.

Conclusion

One of the biggest consumer trends is the shift to more energy-efficient, eco-friendly housing. Not only are consumers more concerned with caring for our environment, there is heavy emphasis on looking for ways to save on monthly outgoings and energy-efficient homes are an appealing way to do this. Property developers should consider this selling point for any redevelopment project and consider newer, more energy efficient building materials such as ICF blocks, or integrating smart technology.

The pandemic brought with it an increase in demand for outside space, although this is levelling off as normal life resumes and the pandemic becomes more of a distant memory.

A volatile economy and unstable housing market has boosted the demand for more affordable homes; apartments, smaller terraced housing and shared ownership schemes. There will always be a need for affordable properties for first-time buyers, although the end of the ‘help to buy’ scheme has drastically reduced the size of this market (for now).

Hunter Finance are an independent lender of property development finance, offering loans to new and experienced developers. Get in contact today to discuss a property development project in the South East of England.