Nothing stands still in property development and finance, with turbulent conditions across the globe making things unpredictable and volatile. So we can stay on top of things and keep informed, we’ve compiled the most essential property development finance news of the past few months. You’re welcome!

UK homeowners and first-time buyers warned to brace for 5%-plus mortgage rates – The Guardian

The Guardian reported in May that those looking for new mortgages should expect rates of 5% upwards. Due to inflation figures announced on Wednesday the 24th of May, markets went back into turmoil.

“The prospect of 5% mortgages would be a further blow to potential first-time buyers and households hoping to remortgage their existing deal. It’s the latest turn in what is fast becoming a year of mortgage turmoil.

A household with an expiring 2.99%, £150,000 mortgage would have to find an extra £175 a month or £2,100 a year if their replacement mortgage was priced at 5.19% – on top of recent food price increases of nearly 20%.”

Although things are certainly still chaotic within the property market, they are calmer than the days and weeks after the infamous September 2022 mini-budget where the price of many new fixed home loan deals rose above 6%.

Read the full story in The Guardian.

£1.3bn of development potential currently held in Class Q sites – Development Finance Today

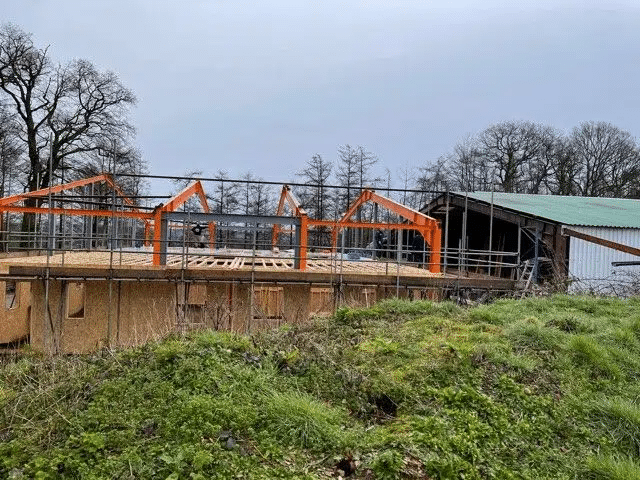

Research from Searchland has revealed an estimated £1.3bn worth of development potential currently held within Class Q sites across the market in England. They analysed the number of Class Q sites available across England, the total building area they occupy, and their current market value. These sites allow the repurposing of agricultural buildings into residential use to ease housing pressure in rural areas.

The article says “There are a wealth of existing agricultural buildings that are ripe and ready for redevelopment into residential housing and, in the current market, they are worth a considerable sum.”

Read the full story on Development Finance Today

Bridging Loans: A Brighter Outlook – Financial Reporter

Lending markets have settled down after the turmoil which began in the second half of 2022. Bridging lenders intervened to help investors and landlords when term lenders withdrew last year. Although buy-to-let providers have mostly returned to the fold, bridging is still strong. There’s plenty of demand from customers who need to move quickly in situations where a chain is breaking down, and brokers have been helping those who feared that they would miss out on their next home.

Read the full story at Financial Reporter

Bridging lending jumps 68% in Q1 to hit record high – Financial Reporter

Bridging lenders transacted a record-breaking £278.8 million in bridging loans during the first quarter of 2023 – a 30% increase on the previous record (£214.7 million in Q3 2022) and a 68% jump on Q4 2022 (£166.3 million), according to the latest data from Bridging Trends.

Read the full story at Financial Reporter

Two homes need to be retrofitted every minute to meet energy-efficiency targets – Development Finance Today

According to the UK Green Building Council (UKGBC), 80,000 homes will need modifications every month between now and 2050 to meet targets. The UK has some of the oldest housing stock in Europe, with 20% of homes built pre-1919 and approximately 50% having uninsulated walls. However, 80% of buildings in use today are expected to still be inhabited in 2050.

The UKGBC is strongly advocating for the government to develop a nationwide retrofit programme to deliver the upgrades to energy efficiency that the housing stock urgently needs.

Read the full story at Development Finance Today

For more information about development finance, refer to our Guides or get in contact with us.