If you own extra land, a granny annexe, or unused outbuildings in Hampshire, East Sussex, West Sussex, Kent, Surrey or Essex, you might be sitting on a golden opportunity.

With UK holiday homeowners earning an average of £24,700 per property according to Sykes Holiday Cottages’ 2025 report, building a purpose-designed holiday let could be a lucrative investment. However, creating accommodation for short-term guests involves different considerations than building a standard residential home.

With that in mind, this blog post explores what it takes to build a holiday let, the pros and cons of the decision, and the short- and long-term costs involved.

Planning Permission for Building a Holiday Let

The first major difference when building a holiday let is the planning permission process, as it’s often more complex than for a normal residential property.

If you’re building a property on unused land with the intention of using it as a holiday let, or converting a building that hasn’t been used as a residence before, you’ll need to consider what planning use class applies and whether you need permission for a change of use. You’ll also need to understand whether there are any letting clauses associated with the land and building, and/or whether your mortgage lender has any letting restrictions.

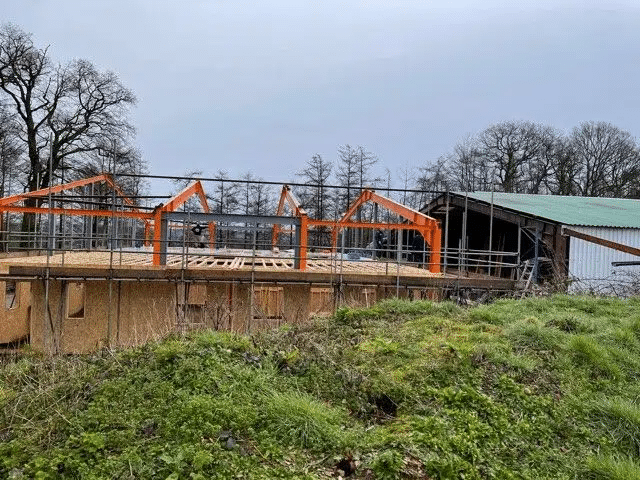

Some conversions can be carried out under Permitted Development Rights. So if you’re converting an agricultural building like a barn, workshop or stables, you may be able to proceed without full planning permission, though you’ll still need to submit a prior approval notice to your local authority.

For example, London and Brighton & Hove both have restrictions on the creation of new holiday lets to protect residents. Many other local authorities are also reported to be exploring similar schemes.

Understanding Building Regulations & Safety Standards

While all the same building regulations apply to holiday lets as they do to normal residential properties, there are additional safety standards that must be met:

- Fire safety: A fire risk assessment is legally required under the Fire Safety Order 2005 to determine high-risk areas. Proper detection systems, escape routes, and fire safety equipment (that’s regularly tested) will need to be installed accordingly.

- Electrical safety: Compliance with the Electricity at Work Regulations 1989 requires regular checks and PAT testing of all electrical appliances.

- Gas safety: Annual gas safety certificates from qualified engineers are essential if installing gas appliances.

- Health & safety: You should also consider general health and safety hazards and take reasonable steps to mitigate these. For example, consider areas where guests may slip, trip or fall easily. Could you install signage, guard rails, non-slip flooring or other measures to help reduce the risk?

- Water safety: The HSE have specific guidelines to consider if you plan to have a swimming pool or hot tub. However, you also need to consider waterborne diseases like Legionnaires if you expect water systems to lie dormant for long periods. Failure to do so can result in fines that could go into hundreds of thousands of pounds.

Designing a Desirable Holiday Let

Holiday lets command premium rates when they offer something special, and well-designed holiday properties can achieve rental yields of 13.5%, compared to just 6% for standard long-term lets.

That means putting some thought into the space. For example, a larger property for groups would benefit from plenty of outdoor seating and large, open-plan living areas for socialising. Smaller spaces intended for couples might be more popular with cosy areas to relax and unwind.

Likewise, if you’re building near the coastlines of Kent or Sussex, the rolling countryside of the South Downs, or the heathland of Hampshire’s New Forest, do what you can to make the most of panoramic views or easy access to walking trails.

The Short- and Long-Term Financial Implications

The South East is a popular destination for visitors. Cities like Brighton and London are great for weekend getaways, while the beautiful countryside and stunning white cliffs are ideal for people looking for something more peaceful.

Like all property development projects in the area, you’ll have to contend with higher land prices, as well as increased labour costs for your project, but with the potential for higher rental returns.

That said, holiday rentals involve ongoing expenses for marketing, cleaning, insurance, maintenance and platform fees. You will also be liable to pay tax on the rental income, as well as SDLT, as it may be considered a second home.

Financing Your Holiday Let

Building a holiday let often requires specialist property development finance and expertise.

At Hunter Finance, we understand the South East market and can provide property development finance that bridges the gap between land purchase, construction, and refinancing once the property is generating income.

We’re always eager to work with developers and turn exciting ideas into reality, so contact us today to find out more. We can often provide an agreement in principle within 7 days, so you can get started on your project.